Gaps refer to areas on a chart where the price of a currency or stock moves sharply up or down with little or no trading in between.As this area represents an abnormality in the normal price pattern of the stock/instrument, it gets referred to as a gap. Gaps occur as a result of underlying fundamental and technical factors that vary for each financial market and require monitoring and knowledge by the investor.

What are Gaps?

Gaps are sharp breaks in price with no trading occurring in between. Gaps can happen moving up or moving down. In the forex market, gaps primarily occur over the weekend because it is the only time the forex market closes. Gaps may also occur on very short timeframes such as a one-minute chart or immediately following a major news announcement.There Are Four Types of Gap Classifications:

- Breakaway Gaps: Gaps that occur at the end of a price pattern and signal the beginning of a new trend.

- Exhaustion Gaps:These gaps occur near the end of a price pattern and signal a final attempt to hit new highs or lows.

- Common Gaps: These gaps don’t get placed in a price pattern; they simply represent an area where the price has “gapped.”

- Continuation Gaps: Continuation gaps occur in the middle of a price pattern and signal a rush of buyers or sellers who share a common belief in the underlying stock’s future direction.

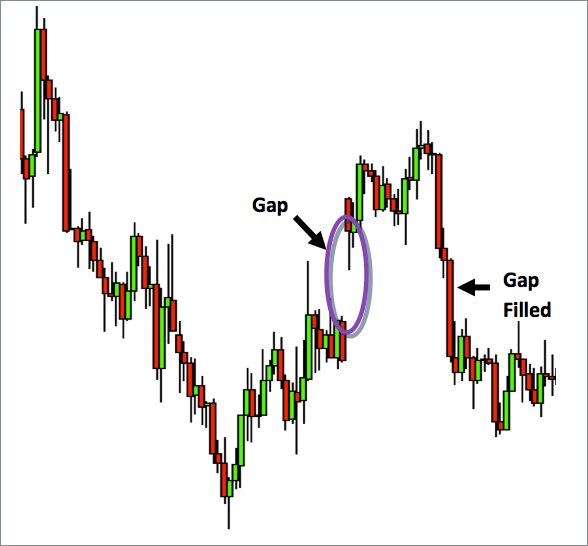

Gaps Fill Quickly

The operating window for gaps can be perilously short, as the market

tends to fill the gaps in quickly. When a gap does get filled, the price

has moved back to the original pre-gap level. Overly optimistic or

pessimistic views, referred to as irrational exuberance, can invite a

gap fill, as can prices moving up or down quickly. When gaps get filled

within the same trading day on which they occur, this is referred to as

fading.

There are many ways to take advantage of these gaps. A few popular

strategies include buying when the technical factor favor a gap on the

next trading day, buying/selling into liquid positions at the beginning

of a price movement in hopes of a good fill, fade gaps in the opposite

direction once a high or low point has been determined, or buying when

the price level reaches the prior support after a gap has filled.

Once a stock has started to fill the gap, it will rarely stop because

of a lack of immediate support or resistance. The gaps also predict the

price moving in two different directions, so an investor needs to

correctly classify which gap they’re playing. Wait for the price to

start to break before taking a position, and keep an eye on the volume;

breakaway gaps should show high volume and exhaustion gaps should read

low.

Due to the low liquidity and volatility of gaps, playing them can be

risky, especially in the diverse forex market. But if properly traded,

gap trading can offer opportunities for quick profits.

Examples of when gappage can occur include:

- When economic data is released – particularly if it contains data that the market isn’t expecting

- As major news events are announced, particularly global and/or unexpected news When trading resumes after a weekend or holiday – especially if major news is announced in that period

Why are they important?

Gaps can give an idea of market sentiment. When a market gaps up,

that means there were zero traders willing to sell at the levels of the

gap. When a market gaps down, that means there were zero traders willing

to buy at the levels of the gap. There are also important to be aware

of because it is possible to gap past a stop order and get filled at

worse price than your stop order.

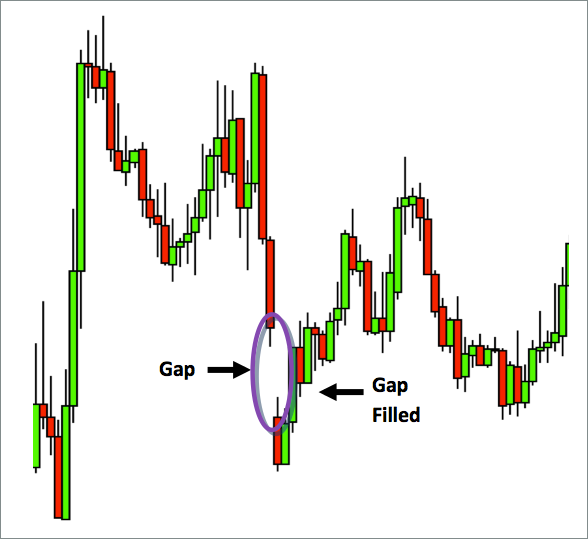

Gaps sometimes result in corrective price action. In other words,

after the gap occurs prices have a tendency to reverse and “fill” the

gap.

So how do I use them?

If there is a gap, generally that is a signal to stay out of the market. Gaps can show strength in the direction of the gap or they can “close” by having prices move in the opposite direction of the gap to at least where the gap began. If there is a gap immediately before the entry of a trade, it may be wise to cancel the trade.Gap up (EUR/JPY, 1 hour)

Gap down (AUD/USD, 1 hour)

What Is Slippage?

Slippage is the difference between the expected price of a trade and

the price at which the trade actually executes. Market gaps can cause

slippage which may affect stop and limit orders – meaning they will be

executed at a different price from that requested.