One of the most important ingredients for successful Forex trading is chart pattern technical analysis. Recognizing figures on the graph is an essential part of the Forex strategy of every trader. It is vital that you learn chart patterns and their meaning. Therefore, I have decided to spare some time to show you how to trade chart patterns like the pros. In this article, I will reveal to you the three best chart patterns for intraday trading and the rules you need to follow when approaching them.

Understanding Chart Patterns in Technical Analysis

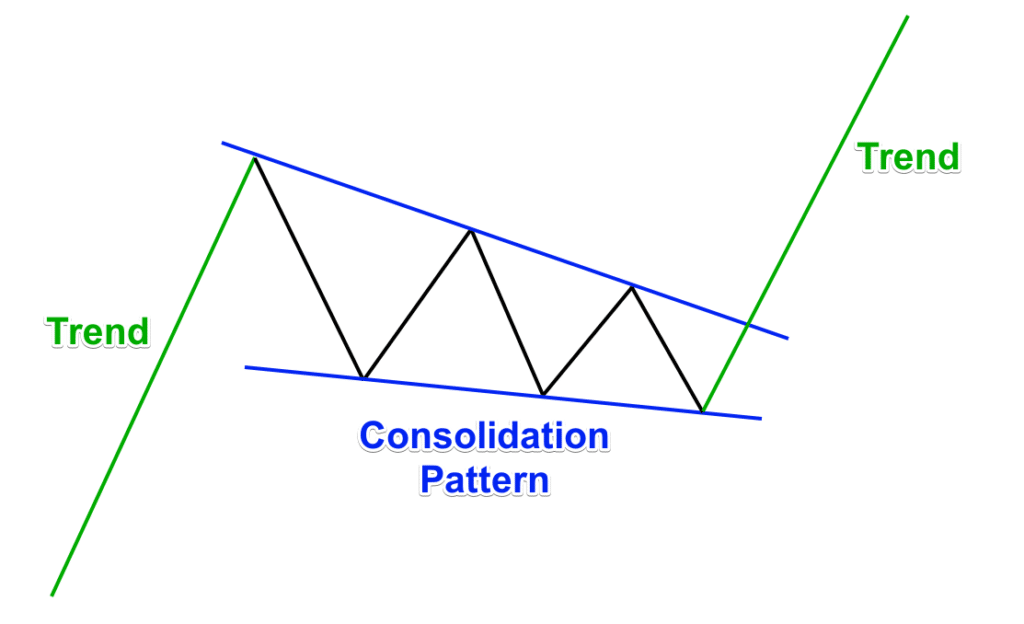

Chart patterns are a crucial part of the Forex technical analysis. Patterns are born out of price fluctuations, and they each represent chart figures with their own meanings. Each chart pattern indicator has a specific trading potential. This is why Forex traders spot chart patterns for day trading – to profit from the expected price moves.In fact, chart patterns represent price hesitation. When you have a trend on the chart, it is very likely to be paused for a while before the price action undertakes a new move. In most cases, this pause is conducted by a chart pattern, where the price action is either moving sideways, or not very persuasive with its move.

This is a brief sketch of how a chart pattern indicator could look like on the chart. In the example above we have a trend that turns into a consolidation, and then the trend is resumed again.

Types of Chart Patterns in Forex

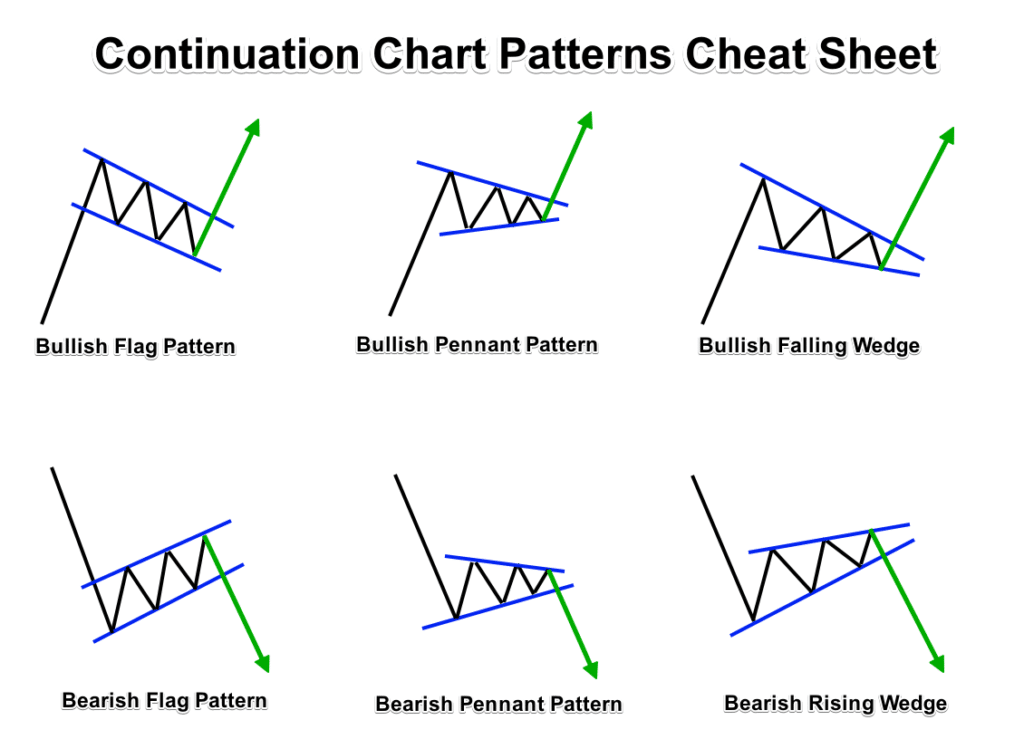

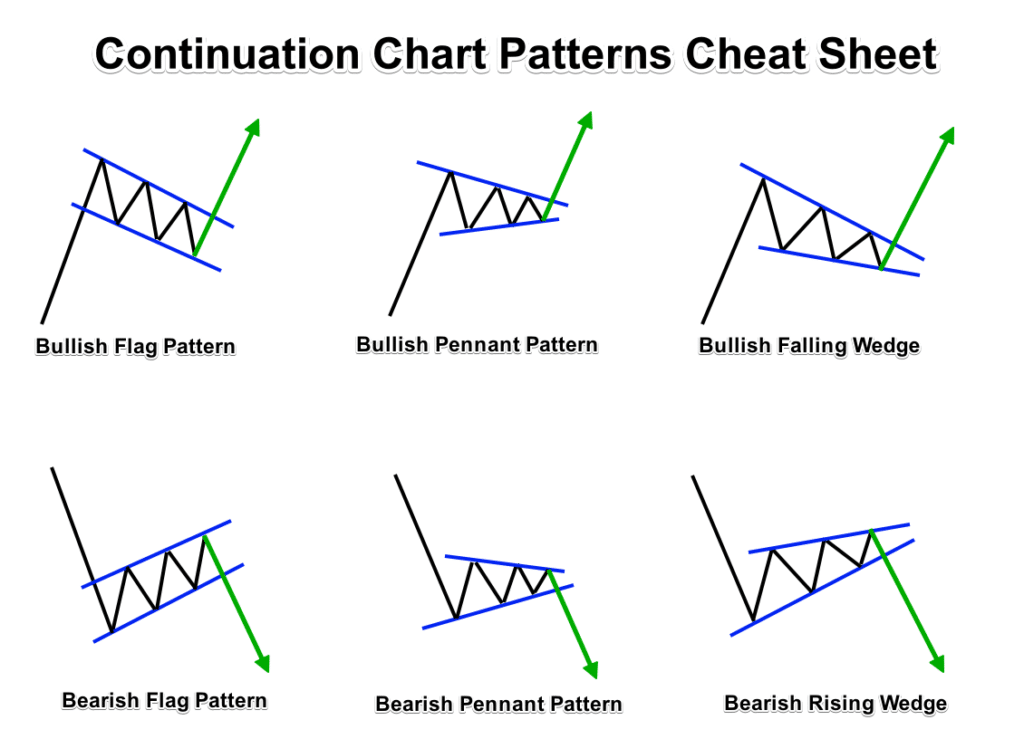

There are three types of chart pattern figures in Forex based on their potential: neutral, continuation, and reversal chart patterns. Next, I will share with you a Forex chart patterns cheat sheet for each of the three types.Continuation Chart Patterns

Continuation chart patterns are the ones that are expected to continue the current price trend, causing a fresh new impulse in the same direction.Example: If you have a bullish trend, and the price action creates a continuation chart pattern, there is a big chance that the bullish trend will continue.

Some of the most popular continuation chart patterns are Flag, Pennant, and Wedges.

This chart pattern cheat sheet shows six of the most common continuation chart patterns in Forex trading. Each of these six formations has the potential to activate a new impulse in the direction of the previous trend.

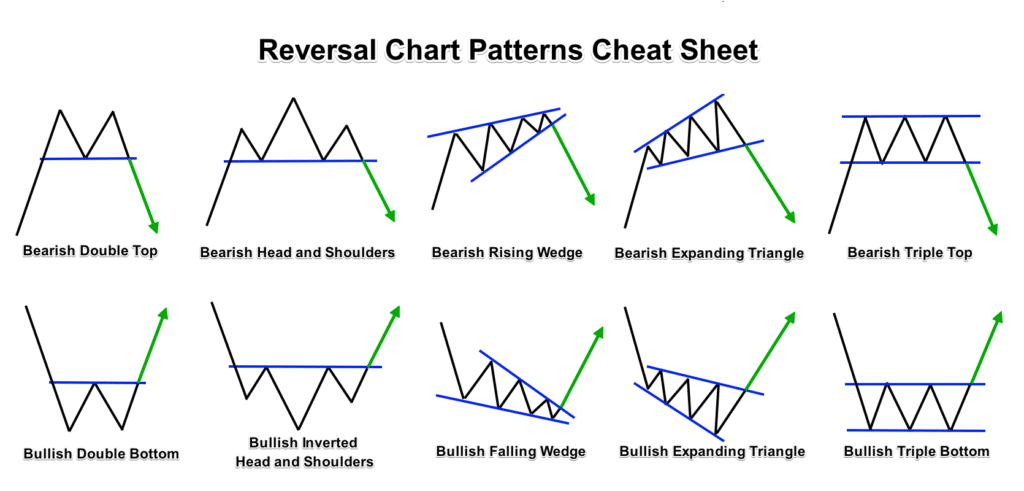

Reversal Chart Patterns

Reversal patterns are opposite to continuation patterns. They usually reverse the current price trend, causing a fresh move in the opposite direction.Example: If you have a bullish trend and the price action creates a trend reversal chart pattern, there is a big chance that the previous bullish trend will be reversed. This is likely to cause a fresh bearish move on the chart.

Some of the most popular reversal chart patterns are Double Tops and Bottoms, Head and Shoulders, Wedges, Expanding Triangles, Triple Tops and Bottoms, etc.

Notice that the Rising and the Falling Wedge could act as reversal and continuation patterns in different situations. This depends on the previous trend. Just remember that the Rising Wedge has bearish potential and the Falling Wedge has bullish potential, no matter what the previous trend is.

Double Bottom Chart Pattern Video

See below for the opportunity to watch a free video that shows a real trading example with the Double Bottom Chart Pattern. The video shows a bullish trade taken as a result of a breakout through the trigger line of the pattern.Neutral Chart Patterns

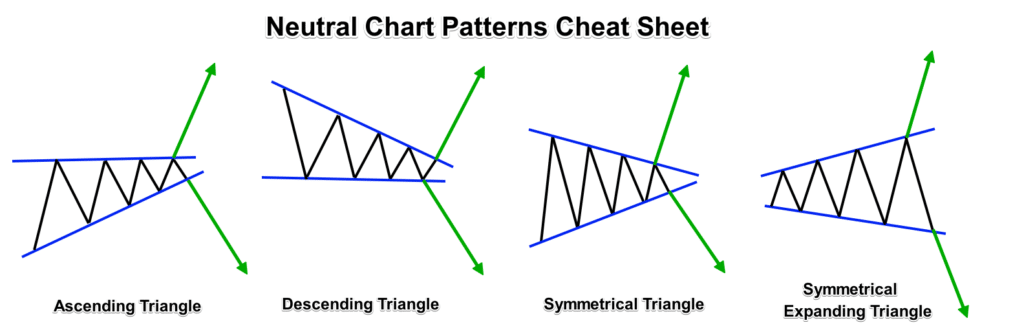

The neutral chart patterns are the ones that induce a price move, but the direction is unknown. In the process of the pattern confirmation, traders realize the pattern’s potential and tackle the situation with the respective trade.Example: The Forex pair is trending in the bullish direction. Suddenly, a neutral chart pattern appears on the chart. What would you do in this case? You should wait to see in which direction the pattern will break. This will give you a hint about the potential of the pattern.

The most popular neutral chart patterns are the Ascending Triangle, Descending Triangle, Symmetrical Triangle, and Symmetrical Expanding Triangle.

These are the most common neutral chart patterns that have the potential to push the price in either the bullish or the bearish direction.

Now you have 20 different chart pattern examples. But which are the best chart patterns to trade?

This will be discussed in the next part of the article.

3 Best Chart Patterns to Trade in Forex

Now that I have given you a brief visual guide to chart patterns, I will tell you which three of these are the best chart patterns for intraday trading. Then I will give you a detailed explanation about the structure and the respective rules of each one of the best chart patterns.Flags and Pennants Chart Patterns

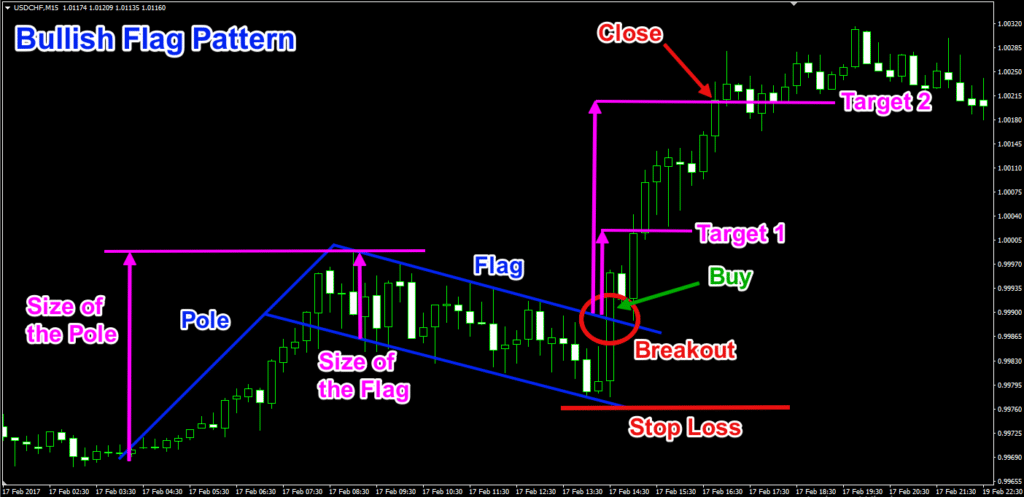

The Flag and the Pennant are two separate chart patterns that have price continuation functions. However, I like to treat these as one as they have a similar structure and work in exactly the same way.The Flag chart pattern has a continuation potential on the Forex chart. The bull Flag pattern starts with a bullish trend called a Flag Pole, which suddenly turns into a correction inside a bearish or a horizontal channel.

Then if the price breaks the upper level of the channel, we confirm the authenticity of the Flag pattern, and we have sufficient reason to believe that the price will start a new bullish impulse.

For this reason, you can buy the Forex pair on the assumption that the price is about to increase. Place your Stop Loss order below the lowest point of the Flag.

The Flag pattern has two targets on the chart. The first one stays above the breakout on a distance equal to the size of the Flag. If the price completes the first target, then you can pursue the second target that stays above the breakout on a distance equal to the Flag Pole.

Check out this Flag chart pattern example to see how it works in a real-life trading situation:

This is an example of a bullish Flag chart pattern on the 15-minute chart of the USD/CHF for February 17, 2017.

The two pink arrows show the size of the Flag and the Flag Pole, applied starting from the moment of the Flag breakout. The Stop Loss order of this trade stays below the lowest point of the Flag as shown on the image.

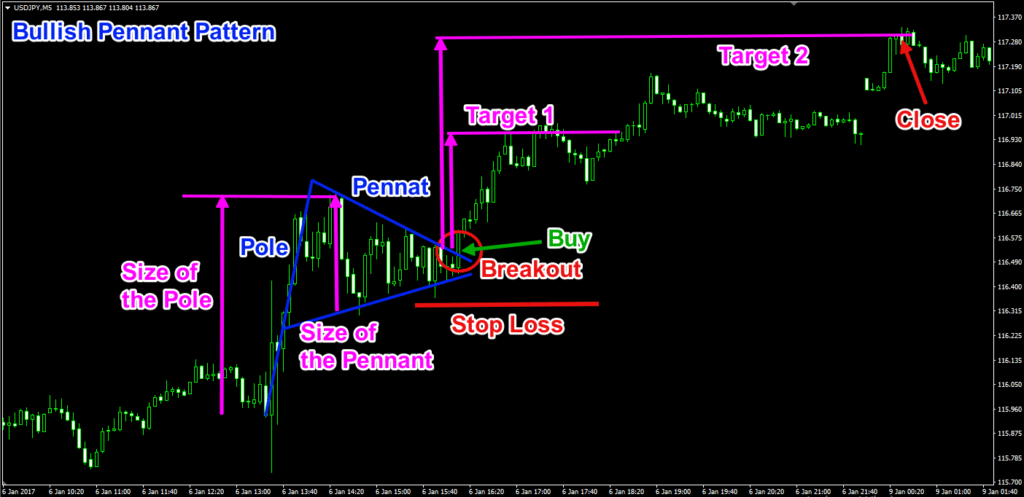

The Pennant chart pattern has almost the same structure as the Flag. A bullish Pennant will start with a bullish price move (the Pennant Pole), which will gradually turn into a consolidation with a triangular structure (the Pennant). Notice that the consolidation is likely to have ascending bottoms and descending tops.

If the price breaks the upper level of the Pennant, you can pursue two targets the same way as with the Flag. The first target equals the size of the Pennant and the second target equals the size of the Pole.

At the same time, your Stop Loss order should go below the lowest point of the Pennant.

The bearish Flag chart pattern works exactly the same way but in the opposite direction.

This time we approach the 5-minute chart of the USD/JPY for January 6, 2017. The image gives an example of a bull Pennant chart pattern.

As you see, Flags and Pennants technical analysis works exactly the same way. The only difference is that the bottoms of the Pennant pattern are ascending, while the Flag creates descending bottoms that develop in a symmetrical way compared to the tops. This is the reason why I put the Flag and Pennant chart patterns indicator under the same heading.

Double Top and Double Bottom Chart Pattern

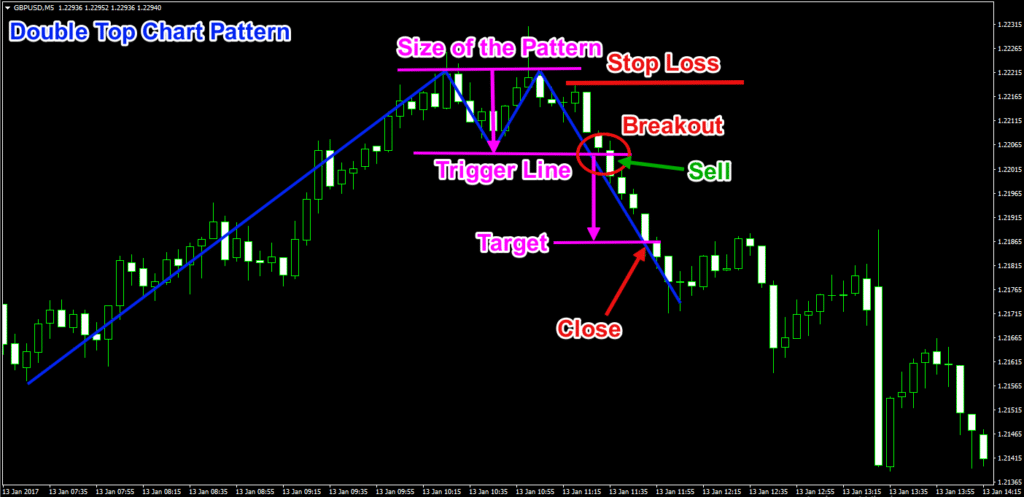

The Double Top is a reversal chart pattern that comes as a consolidation after a bullish trend, creates couple tops approximately in the same resistance area and starts a fresh bearish move.Conversely, the Double Bottom is a reversal chart pattern that comes after a bearish trend, creates couple bottoms in the same support area, and starts a fresh bullish move.

We will discuss the bullish version of the pattern, the Double Top chart pattern, to approach the figure closely.

To enter a Double Top trade, you would need to see the price breaking through the level of the bottom that is located between the two tops of the pattern. When the price breaks the bottom between the two tops, you can short the Forex pair, pursuing a minimum price move equal to the vertical size of the pattern measured starting from the level of the two tops to the bottom between the two tops.

Your Stop Loss order should be located approximately in the middle of the pattern.

The 5-minute chart of the GBP/USD for January 13, 2017, shows an example of a Double Top pattern technical analysis. The pink lines and the two arrows on the chart measure and apply the size of the pattern starting from the moment of the breakout.

After the breakout entry signal on the chart, you need to short the GBP/USD Forex pair placing a stop loss order inside the pattern. In our case, I use a small top after the creation of the second big top to position the Stop Loss order.

Notice that the Double Bottom chart pattern works exactly the same way but in the opposite direction.

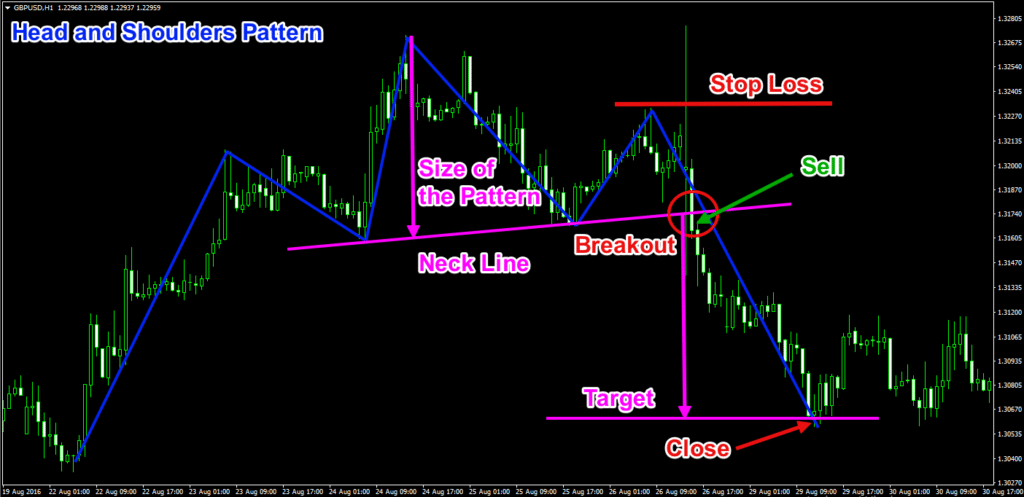

Head and Shoulders Chart Pattern

The Head and Shoulders is another famous reversal pattern in Forex trading. It comes as a consolidation after a bullish trend creating three tops. The first and the third tops are approximately at the same level. However, the second top is higher and stays as a Head between two Shoulders. This is where the name of the pattern comes from.The Head of the pattern has a couple bottoms from both of its sides. The line connecting these two bottoms is called a Neck Line. When the price creates the second shoulder and breaks the Neck Line in a bearish direction, this confirms the authenticity of the pattern.

When the Neck Line breaks, you can pursue the bearish potential of the pattern that is likely to send the price action downward on a distance equal to the size of the pattern – the vertical distance between the Head and the Neck Line applied starting from the moment of the breakout.

Your Stop Loss order in a Head and Shoulders trade should go above the second shoulder of the pattern.

Above you can see a real Head and Shoulders chart pattern on the H1 chart of the GBP/USD for August 19-30, 2016. The inclined pink line is the Neck Line of the figure. The two arrows measure and apply the size of the Head and Shoulders starting from the moment of the breakout through the Neck Line. The red circle shows the head and shoulders chart pattern breakout.

You need to hold a bearish trade until the price completes the size of the pattern in a bearish direction. At the same time, your Stop Loss order should go above the second shoulder as shown on the chart.

As with the other patterns we have discussed, the Head and Shoulders chart pattern has its opposite version – the Inverse Head and Shoulders pattern. It acts absolutely the same way, but everything is upside down.

Chart Patterns Indicator MT4

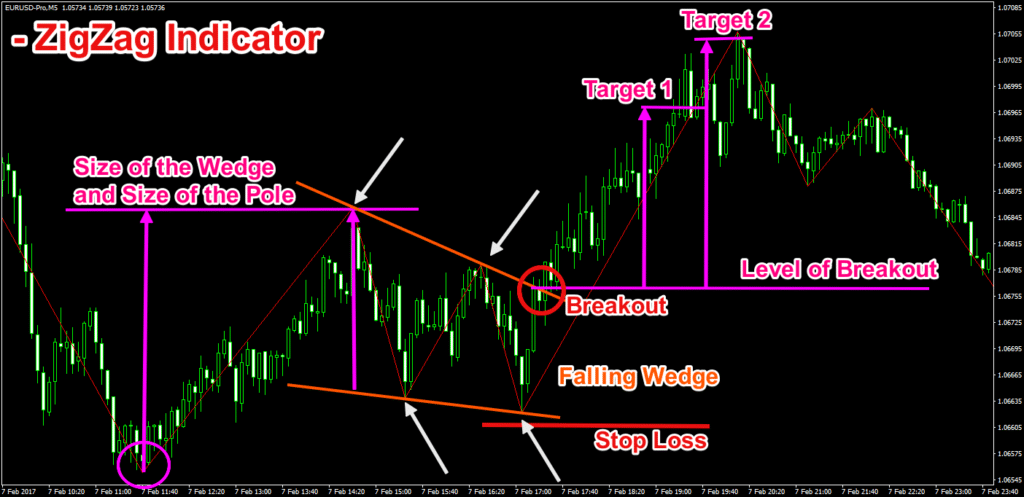

After all my years dealing with financial markets, I have found a very useful tool: a chart pattern recognition indicator. Even better, it is built in to the default version of the MT4 trading platform.The indicator is called ZigZag. What it does is to represent the general price action with straight lines by neglecting smaller price fluctuations and putting emphasis on the real-deal price moves. This way you can very easily visualize a real pattern on the chart.

Let me show you my chart pattern recognition algorithm in action:

Above you can see the 5-minute chart of the EUR/USD for February 7, 2017. The chart includes the ZigZag indicator expressed by the straight red lines on the chart.

In the middle of the chart, we see that the ZigZag lines are creating descending tops and descending bottoms, which is a symptom of a Falling Wedge chart pattern. See that the highs and the lows of the pattern stand out in a very pleasant way thanks to the ZigZag indicator. You can hardly miss the pattern on the chart.

In the red circle we see the breakout through the upper level of the pattern – the confirmation. Then we can trade for the two targets of the pattern. The first one equals the size of the wedge – marked with the smaller pink arrow. The bigger pink arrow measures the size of the Pole. Both should be applied starting from the moment of the breakout.

Notice that you should protect your trade with a Stop Loss order that needs to go below the lowest bottom of the Falling Wedge pattern, as shown in the image.

As you see, the price action completes both targets.

Conclusion

- The chart patterns technical analysis is a crucial part of the Forex price action trading.

- Chart patterns represent price hesitation (consolidation) that comes after a trend.

- After the consolidation is completed, the price action usually creates a big move.

- There are many chart patterns in Forex trading and each of them has its own different meaning.

- There are three types of chart patterns in technical analysis based on their potential.

- Continuation Chart Patterns: Flag, Pennant, Wedges, etc.

- Reversal Chart Patterns: Double Tops and Bottoms, Head and Shoulders, Wedges, Expanding Triangles, Triple Tops and Bottoms, etc.

- Neutral Chart Patterns: Ascending Triangle, Descending Triangle, Symmetrical Triangle, Symmetrical Expanding Triangle, etc.

- The three best chart patterns for intraday trading are:

- Flags and Pennants

- Open a trade when the price breaks out of the Flag/Pennant in the direction of the previous trend.

- Put a Stop Loss order at the other side of the pattern.

- Stay in the trade for a price move equal to the size of the Flag/Pennant. If this target is reached and the price keeps trending in your favor, stay in the trade for an additional price move equal to the size of the Pole applied starting from the moment of the breakout.

- Double Top and Double Bottom

- Open your trade when the price breaks the Trigger Line of the pattern.

- Put a Stop Loss order inside the pattern, somewhere near the mid point.

- Stay in the trade for a minimum price move equal to the size of the pattern.

- Head and Shoulders

- Open a trade when the price breaks the Neck Line of the pattern.

- Put a Stop Loss order beyond the second shoulder.

- Stay in the trade for a minimum price move equal to the size of the pattern.

- Flags and Pennants