Scalping is one of the toughest yet most rewarding skill a forex trader can have. Many seasoned traders would advise not to start scalping until you are used to trading on the longer timeframes. This is because scalping involves a whole lot of concentration, quick thinking, a trained eye, and ultra-fast decision making. It involves sitting in front of your computer until you see a trade coming.

However, it is still rewarding and is very profitable because the scalper could cash-in on those tiny fluctuations of price going back and forth. A swing trader may look at a chart and say a currency moved 120 pips on that day, but to the scalper, it moved 300-400 pips that day going back and forth before ending the day. And to him, he could have made money on those many little fluctuations. The

more price moves, the more chances he gets to earn from those tiny moves. A few pips every now and then could rack up to a big amount at the end of the day.

Another thing that scalpers do is that they could rack-up their position sizes due to the fact that they are only risking a few pips. Risking 1% of your equity on 10 pips stop loss would mean that you could increase your position size as compared to risking 1% of your equity on 50 pips stop loss. This allows the trader to leverage more on those small trades and earn big on tiny price fluctuations.

You could hear stories of forex traders gaining 30%, 50%, even a 100% profit in a few months just by doing scalping. And yes, there are many who can do it. But, just to warn you, many also burned their accounts by being undisciplined doing scalping. These are those who trade with emotions and do not follow their rules. They are like machine gunners shooting everything in their path, taking every trade they see, even if it doesn’t fit their rules. Trading should be like sniping, waiting for the perfect trade at the perfect time, and taking the shot without hesitation when the opportunity presents itself.

Now that you’ve been fairly warned, let’s dive straight into how we can trade Pin Bars for scalping.

What is a Pin Bar?

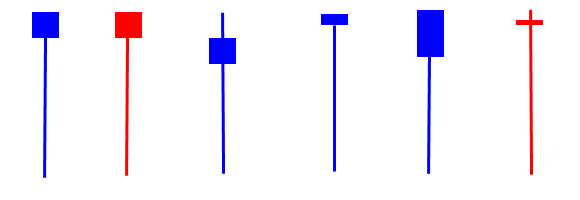

Before we go trading Pin Bars, we should first know what it is. We can’t trade what we can’t identify, and we can’t identify what we don’t know. So, what is a Pin Bar? Pin Bars are candle sticks that look like pins, because they have a smaller body compared to their wicks. A textbook definition would be a candle whose wick is more than twice the size of the body. The samples below are examples of candles that would pass as a Pin Bar.

These are Bullish Pin Bars. If you see those upside down, it would be Bearish Pin Bars.

Now, what is the significance of Pin Bars? Pin Bars, are one of the strongest and most reliable reversal candles that could easily be spotted on a chart. This is because wicks signify rejection of prices. If you see a long wick at the bottom of a candle, it means that price at the bottom is being rejected by the market, thus a bullish trend may occur, and vice versa.

The Time Frame

Since we are trying to do scalping, we will be trading on the 5-minute chart. 1-minute and 3-minute charts could still be done but you would be facing algorithmic robots on that space, who could think and decide in a split second. It could also be done on the 15-minute chart but that is somehow bordering towards day-trading, which is also a very viable and profitable option.The Entry

Now, to trade Pin Bars, we should know where to be looking for it and what direction we should be looking for. Remember, Pin Bars are reversal candles, so we should be looking for Pin Bars that are going the opposite way versus the trend.Also, we should be strict with our rules when it comes to identifying Pin Bars. We would only trade candles with wicks that are twice the size of their bodies and whose bodies are near the edge of the candle. Apart from that, it wouldn’t be considered as a Pin Bar, and we wouldn’t trade it.

The Stop Loss

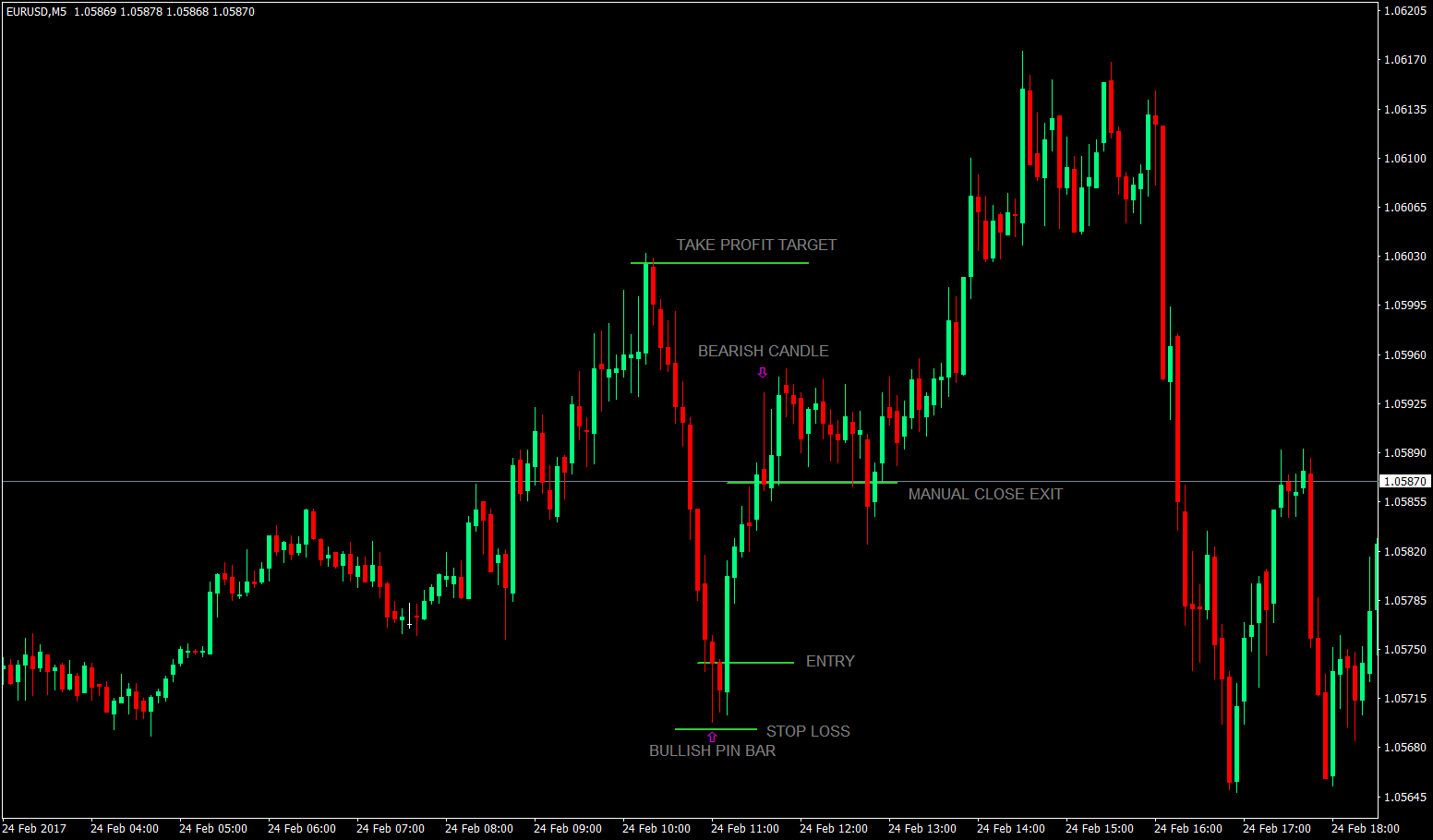

The Stop-Loss would be a few pips from the bottom of the Pin Bar if it is a bullish trade setup, or a few pips above if it is a bearish trade setup.Take Profit & Manual Close on Profit

Our Take Profits would be the fractals or recent higher-highs and lower-lows of previous price action. This is because these are natural horizontal supports and resistances, where price either dropped or shot-up from. If there are multiple reasonable Take Profit targets on the chart, then we could do multiple Take Profits. If none, then we could have just a single Take Profit.Also, if the Take Profit target is too high, there will be times wherein price would not hit the Take Profit right away. To go around this, we could make it part of our rules to manually close the trade if we see reversal candles or price action.

On this trade, we would see a Bullish Pin Bar right at the bottom. It does fit our rules, so we could trade this setup. The Take Profit Target though is quite high, so we would have to be cautious on this trade. As soon as we saw the bearish reversal candle, we should manually close as per our rules. And it did start to flounder a little bit from there. But if you decided to hold the trade, you would have also gained a lot more pips, since the Take Profit target was hit.

Just a few hours after our previous trading opportunity on the same currency pair, we spot another trading setup. This one is a Bearish Pin Bar setup. On this setup, we could have three Take Profit targets, which allows us to gradually cash-in and ensure that we are in profit on this trade. However, we could also see that the trade went smoothly enough, pushing through our first Take Profit, then having a little bounce on the second Take Profit, before bouncing off our final Take Profit.

Conclusion

Pin Bar trading is one of the easiest ways to trade, even as a beginner it could easily be done. Doing it as a scalping strategy though would make it a little tougher, since you would have to decide a tad quicker than the usual. Also, these 2 opportunities are just a few hours apart. In a single chart, you could have 2-5 trading opportunities a day per currency. Take note, you will not be looking at just one currency. You could trade up to 25 different currency pairs just by using the major currencies and the more popular ones. So, opportunity is always present every day if you are doing scalping. But make sure to check the spreads of the currencies, since scalping would require tight spreads.It is up to you to decide if you’d like to give it a try. Who knows, scalping might be for you.